Success Stories

Expansion | Corporation Tax Finance | Asset Finance | VAT Funding | Refurbishment | Self Assessment Tax | Management Buy In

Expansion

This privately-owned provider of specialist workwear and protective clothing based in the North West required £25,000 to enable expansion into an additional commercial unit, to complete a re-brand and overhaul their website and subsequently increase marketing activity following the rebrand.

This privately-owned provider of specialist workwear and protective clothing based in the North West required £25,000 to enable expansion into an additional commercial unit, to complete a re-brand and overhaul their website and subsequently increase marketing activity following the rebrand.

Sector = Workwear and protective clothing specialist

Region = North West

Turnover = c.£600k

Loan = £25,000

Term = 5 years

Corporation Tax Funding

Our client had the money available to pay HMRC in full but decided to obtain finance and retain the cash within the business to use for expansion and investment. HMRC were paid directly by the funder and the client spread the finance over 12 equal payments starting 1 month after funds were released.

Sector = Retail services

Region = North Wales

Turnover = c.£1.9m

Loan = £76,000

Term = 12 months

Asset Finance

This well-established pharmacy required a new dispensing robot as an upgrade replacement to their existing machine. The supplier, as is often the case, provide a finance quote for equipment and Amiga Finance provide the alternative quotation for the client to compare resulting in a saving of just under £20k across the term of the loan.

This well-established pharmacy required a new dispensing robot as an upgrade replacement to their existing machine. The supplier, as is often the case, provide a finance quote for equipment and Amiga Finance provide the alternative quotation for the client to compare resulting in a saving of just under £20k across the term of the loan.

Sector = Pharmaceuticals

Region = Greater Manchester

Turnover = c.£2.9m

Loan = £126,500

Term = 5 years

VAT funding

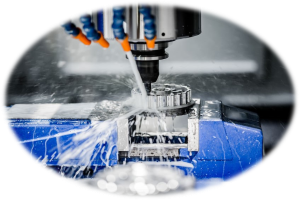

This family owned engineering business wanted to ease pressure on their cashflow by funding their quarterly VAT bill. Funding was put in place and paid out within 1 day with the 1st of 3 monthly repayments being 1 month after HMRC were paid by the funder. The client was able to utilise the money with the business to ensure key creditors were paid to gain beneficial terms.

This family owned engineering business wanted to ease pressure on their cashflow by funding their quarterly VAT bill. Funding was put in place and paid out within 1 day with the 1st of 3 monthly repayments being 1 month after HMRC were paid by the funder. The client was able to utilise the money with the business to ensure key creditors were paid to gain beneficial terms.

Sector = Engineering

Region = Midlands

Turnover = c.£800k

Loan = £27,000

Term = 3 months

Refurbishment

This multi sited Midlands accountancy firm had grown rapidly through organic growth and acquisition resulting in the need to re-plan their existing office and expand into unused space. This enabled them to improve the work space and recruit staff. Funding was established following submission of satisfactory quotes and money was released directly to the client shortly after.

This multi sited Midlands accountancy firm had grown rapidly through organic growth and acquisition resulting in the need to re-plan their existing office and expand into unused space. This enabled them to improve the work space and recruit staff. Funding was established following submission of satisfactory quotes and money was released directly to the client shortly after.

Sector = Accountancy practice

Region = Midlands

Turnover = c.£1.1m

Loan = £100,000

Term = 5 years

Self Assessment Tax

One director of this business opted to fund his January tax over 12 months to enable the pursuit of various personal objectives with the knowledge that HMRC were paid directly by the funder ahead of the deadline.

One director of this business opted to fund his January tax over 12 months to enable the pursuit of various personal objectives with the knowledge that HMRC were paid directly by the funder ahead of the deadline.

Sector = Medical

Region = Greater Manchester

Turnover = c.£90k

Loan = £22,000

Term = 12 months

Management Buy In

2 directors from a multi-million pound turnover buildings and maintenance contractor based in the West Midlands were looking for funding to enable them to buy into the business they were working for. They required a total of £100,000 in funding and this was successfully sourced, underwritten and paid out within 7 days.

2 directors from a multi-million pound turnover buildings and maintenance contractor based in the West Midlands were looking for funding to enable them to buy into the business they were working for. They required a total of £100,000 in funding and this was successfully sourced, underwritten and paid out within 7 days.

Sector = Building and maintenance contractor

Region = West Midlands

Turnover = c.£8m

Loan = £100,000

Term = 5 years